2021 individual federal income tax rate brackets

Tax Rate Reduction Effective January 1 2021 all tax rates have been decreased. The federal corporate income tax system is flat.

Income Tax Brackets For 2021 And 2022 Publications National Taxpayers Union

For the 2021 tax year there are seven federal tax brackets.

. A federal income tax is a tax levied by the United States Internal Revenue Service IRS on the annual earnings of individuals corporations tr u sts and other legal. TurboTax will apply these rates as you complete your tax return. Access state income tax return forms and schedules plus state tax deadlines.

This elimination of the personal exemption was a provision in the Tax Cuts and Jobs Act. On May 10 2021 Governor Brad Little R signed HB. First here are the tax rates and the income ranges where they apply.

Your filing status and taxable income such as your wages determines the bracket youre in. While graduated income tax rates and brackets are complex and confusing to many taxpayers sales taxes are easier to understand. Other useful tax resources.

Since 1937 our principled research insightful analysis. The other six tax brackets set by. See full state rankings for 2021 gas tax rates.

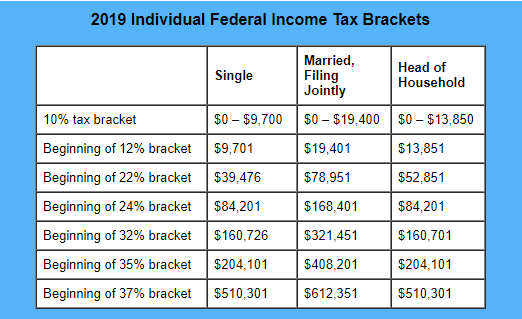

There are seven federal individual income tax brackets. 10 12 22 24 32 35 and 37. See tax brackets for 2021 and estimate your effective tax rate for the current or next tax year.

These tax rate schedules are provided to help you estimate your 2021 federal income tax. 380 reducing the states top marginal individual income tax rate from 6925 to 65 percent while consolidating seven individual income tax brackets into five. Imposes tax on income using by graduated tax rates which increase as your income increases.

An individuals average rate which is referred to as the effective tax rate is their overall federal tax liability. Your bracket depends on your taxable income and filing status. The top marginal income tax rate of 37 percent will hit taxpayers with taxable income of 523600 and higher for single filers and.

24327A TAX AND EARNED INCOME CREDIT TABLES This booklet only contains Tax and Earned Income Credit Tables from the Instructions for Form 1040 and 1040-SR. Dec 16 2021 Cat. 10 12 22 24 32 35 and 37.

These are the federal income tax brackets for 2021 and 2022. These are the federal income tax brackets for 2021 and 2022. Looking at the tax rate and tax brackets shown in the tables above for New York we can see that New York collects individual income taxes differently for Single versus Married filing statuses for example.

For tax year 2021 the top tax rate remains 37 for individual single taxpayers with incomes greater than 523600 628300 for married couples filing jointly. 2020 and 2021 Tax Brackets. California pumps out the highest state gas tax rate of 6698 cents per gallon followed by Illinois 5956 cpg Pennsylvania 587 cpg and New Jersey 507 cpg.

Preserving Limited Losses Idaho taxpayers can keep the benefit of losses that exceed the federal limit and carry them forward as. These changes were retroactive to January 1 2021. We can also see the progressive nature of New York state income tax rates from the lowest NY tax rate bracket of.

Provides that Georgias top marginal individual income tax rate will be reduced to 55 percent for tax years beginning January 1 2020 or later and expiring on December 31 2025 if a joint resolution to reduce the rate is. 115-97 sunsets after 2025 many individual tax provisions including the lower rates and revised brackets in order to. Individual tax provisions are going to expire after 2025.

Find Your Federal Tax Rate Schedules. 2021-2022 federal income tax brackets rates for taxes due April 15 2022. There are seven federal tax brackets for the 2021 tax year.

Tax Changes for 2021 - 2022 - 2020 rates have been extended for everyone. Consumers can see their tax burden printed directly on their receipts. 10 12 22 24 32 35 and 37.

But as a percentage of your income your tax rate is generally less than that. Individual income tax rates now range from 1 to 65 and the number of tax brackets has been reduced from seven to five. Looking at the tax rate and tax brackets shown in the tables above for Oregon we can see that Oregon collects individual income taxes differently for Single versus Married filing statuses for example.

Your tax bracket is the rate you pay on the last dollar you earn. A tax exemption excludes. How high are income taxes in my state.

The federal income tax rates remain unchanged for the 2021 and 2022 tax years. Federal Tax Rates and Brackets. Read on for more about the federal income tax brackets for Tax Year 2021 due April 15 2022 and Tax Year 2022 due April 15 2023.

As noted above the top tax bracket remains at 37. 2021 Federal Income Tax Brackets. 10 12 22 24 32 35 and 37.

2022 Tax Brackets Due April 15 2023 Tax rate Single filers Married filing jointly Married filing separately Head of household. Online is defined as an individual income tax DIY return non-preparer signed that was prepared online either. The income brackets though are adjusted slightly for inflation.

State and federal income tax rules can vary in terms of tax rates allowable deductions and the types of income that are subject to tax. Your tax bracket depends on your taxable income and your filing status. 115-97 reduced both the individual tax rates and the number of tax brackets.

Sales and Use Tax Rate Change Effective 112021 https. Consider adjusting your tax withholding for the 2021 or 2022 Tax Year and estimate your 2021 Taxes ahead of time. Compare 2021 state income tax rates and brackets with a tax data report.

See chart at left. California Illinois and Pennsylvania have the highest gas tax rates. So when you file in 2026 rates will go back to those before Trumps 2018 changes.

The tax year 2021 tax brackets are also already available. There are seven federal tax brackets for tax year 2022 the same as for 2021. For individuals the top income tax rate for 2022 is 37 except for long-term capital gains and qualified dividends discussed below.

Oregon Tax Brackets 2020 - 2021. For tax year 2020 while there were no rate changes the IRS has adjusted Federal tax brackets for inflation by approximately 075-1. 2021 Federal Tax Brackets and Rates 2021 Tax Rate.

FreeFile is the fast safe and free way to prepare and e- le your taxes. New York Tax Brackets 2020 - 2021. These are the rates for taxes due.

The personal exemption for tax year 2021 remains at 0 as it was for 2020. There are seven tax brackets for most ordinary income for the 2021 tax year. We can also see the progressive nature of Oregon state income tax rates from the lowest OR tax rate bracket of 475 to the.

Federal Income Tax.

Low Tax Rates Provide Opportunity To Cash Out With Dividends

2020 Federal Income Tax Brackets

New 2022 Irs Income Tax Brackets And Phaseouts For Education Tax Breaks

What Is My Tax Bracket 2021 2022 Federal Tax Brackets Forbes Advisor

How Is Tax Liability Calculated Common Tax Questions Answered

Federal Income Tax Brackets Brilliant Tax

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

2021 Tax Brackets Standard Deductions Dsj Cpa

2021 Federal Tax Brackets Tax Rates Retirement Plans Western States Financial Western States Investments Corona Ca John Weyhgandt Financial Coach Advisor

2021 Tax Rates For Individual Income Tax Returns Filed In 2022 A Tax Haven

2022 Income Tax Brackets And The New Ideal Income For Max Happiness

2021 2022 Federal Income Tax Brackets Tax Rates Nerdwallet

2021 2022 Federal Income Tax Brackets Tax Rates Nerdwallet

Federal Income Tax Brackets Brilliant Tax

Michigan Family Law Support Jan 2021 2021 Tax Rates 2021 Federal Income Tax Rates Brackets Etc And 2021 Michigan Income Tax Rate And Personal Exemption Deduction Joseph W Cunningham Jd Cpa Pc

2022 Iowa Tax Brackets New 2026 Iowa Flat Tax 0 Retirement Tax

Michigan Family Law Support Jan 2021 2021 Tax Rates 2021 Federal Income Tax Rates Brackets Etc And 2021 Michigan Income Tax Rate And Personal Exemption Deduction Joseph W Cunningham Jd Cpa Pc